By granting an discretionary mandate, you benefit from our experience as professional assets manager. You free yourself from individual decisions, giving you more time to live and enjoy life.

QUICK FACTS:

- Suitable for private and institutional investors

- Flexible and active asset allocation

- Investment amount from CHF 250,000.00

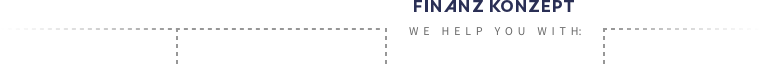

- Bandwidths Risk classes

1.Discuss your needs

As an individual, you are the focus of our initial consultation. We want to understand your life situation, know your goals and take your wishes into account. For us, your personal situation and financials are the foundation of your tailor-made investment solution. In doing so, we leverage our years of experience

to tailor our products and services to your individual interests and to satisfy your needs and preferences.

3.Strategy decision and model selection

Together we determine your investment strategy, based on your goals and wishes. According to your needs and financial situation, you have several individual management models at your disposal. Together we will put together your personal, tailor-made mandate.

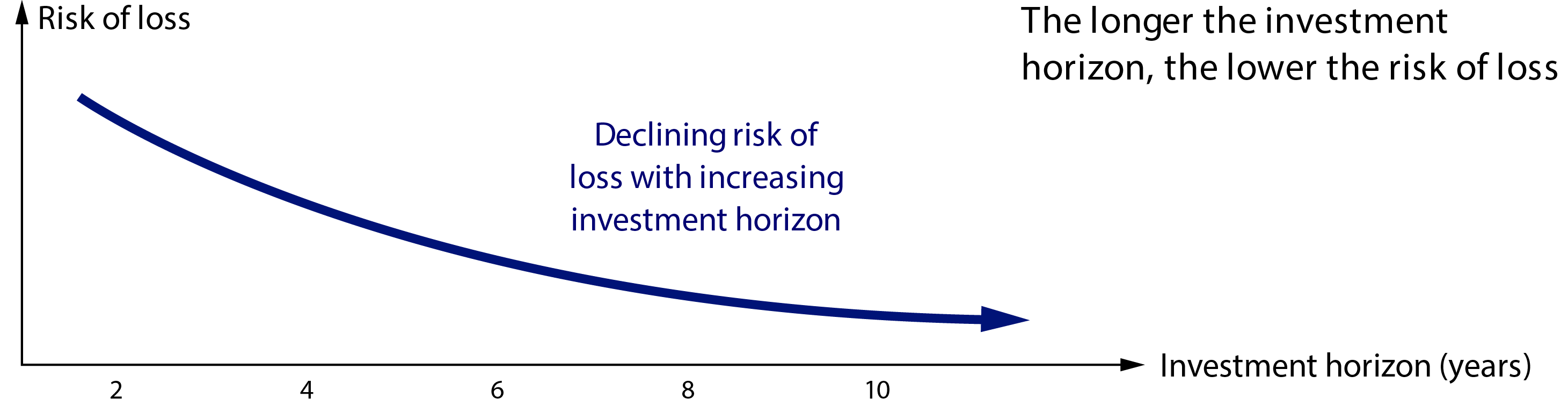

STRATEGY DECISIONS

Three Strategies for Three Different Investor Profiles

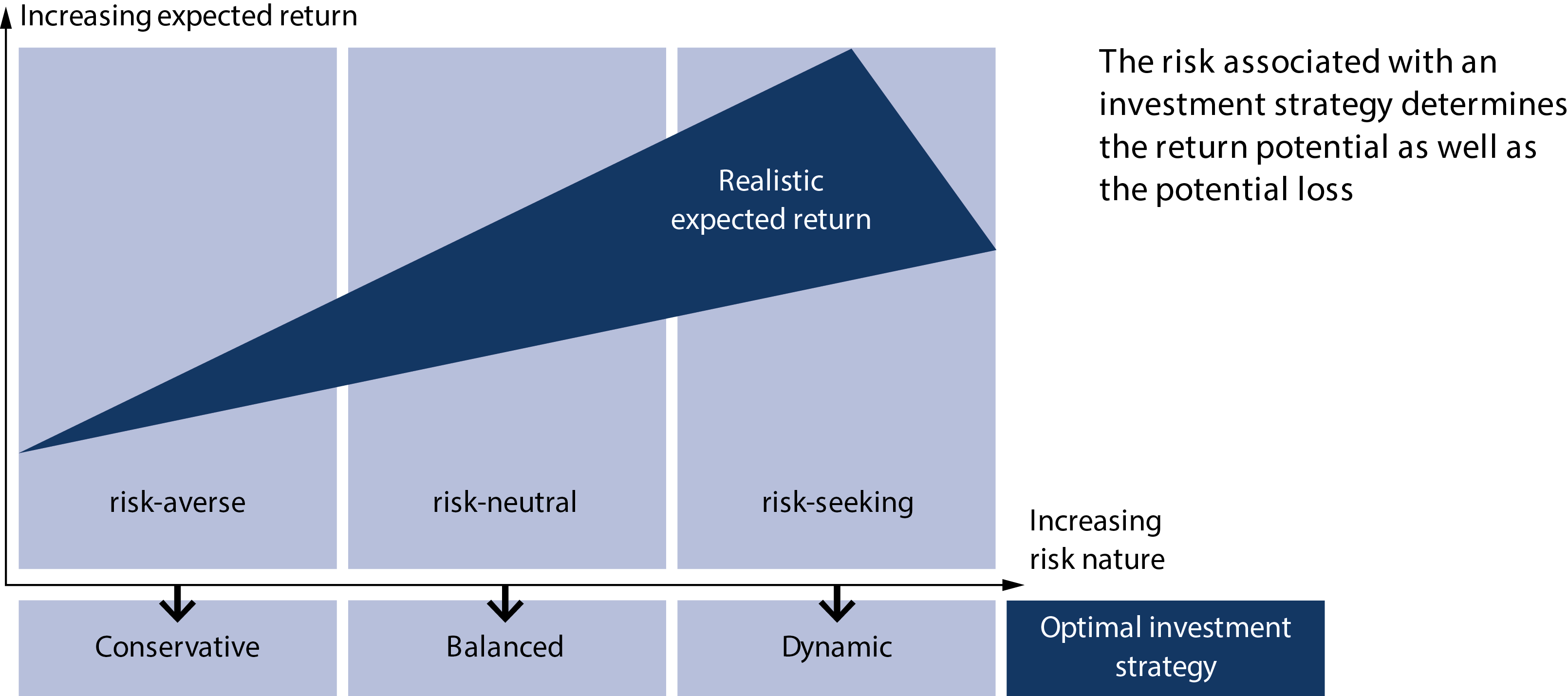

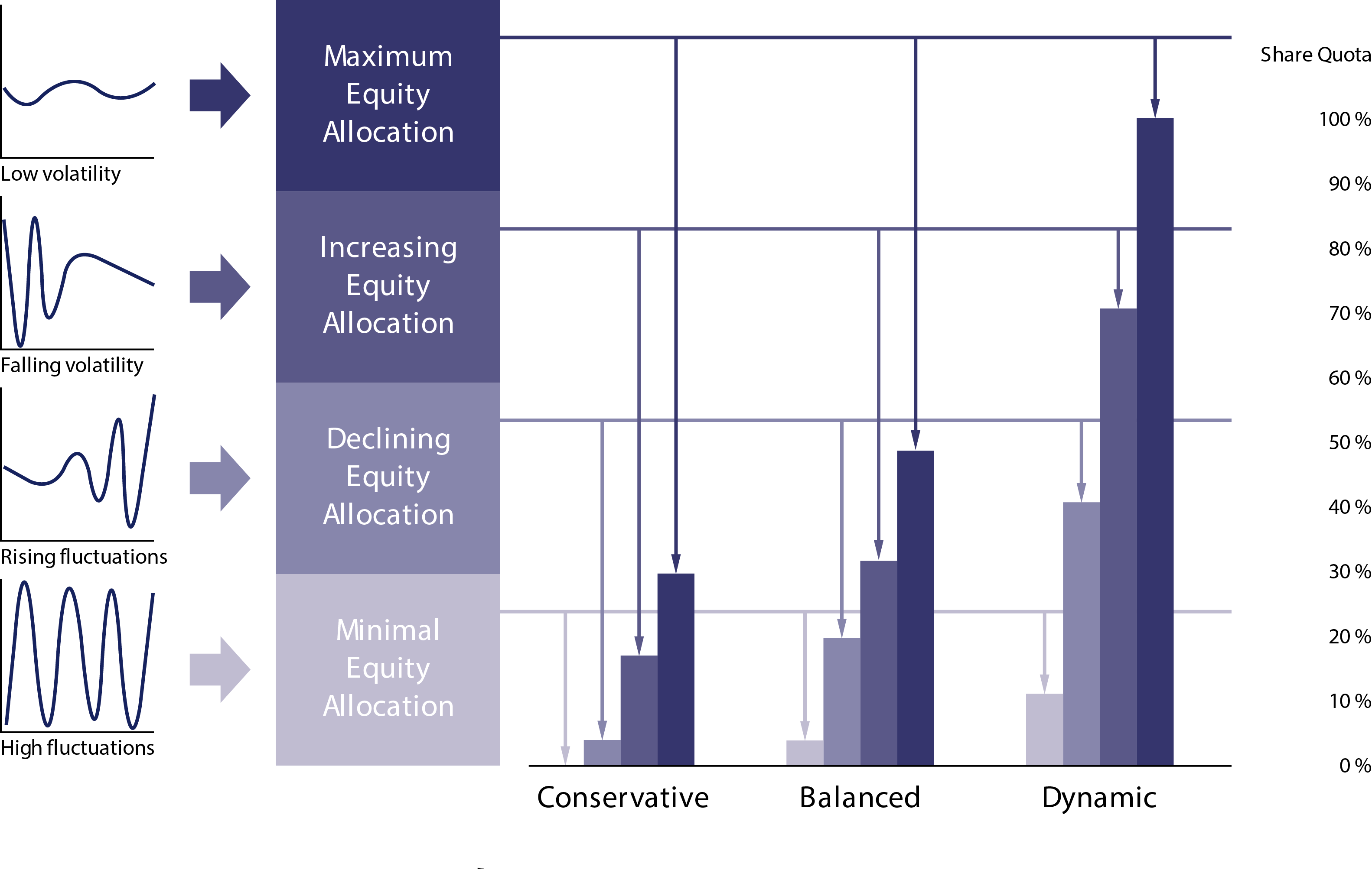

The FK Discretionary Mandate is available in three different risk models, depending on evaluation of your risk appetite, you can choose your individual mandate. The risk models are based primarily on the equity allocation, which we flexibly align depending on the market situation. Equities can deliver better long-term returns than other asset classes. The more flexible the share strategy,

the higher the potential in different market phases. With Finanz Konzept you profit from an innovative and exclusive investment approach, characterised by flexibility. When selecting third party products and third party providers, we focus on independence, risk management and low costs. a single solution gives you access to the entire global investment universe.

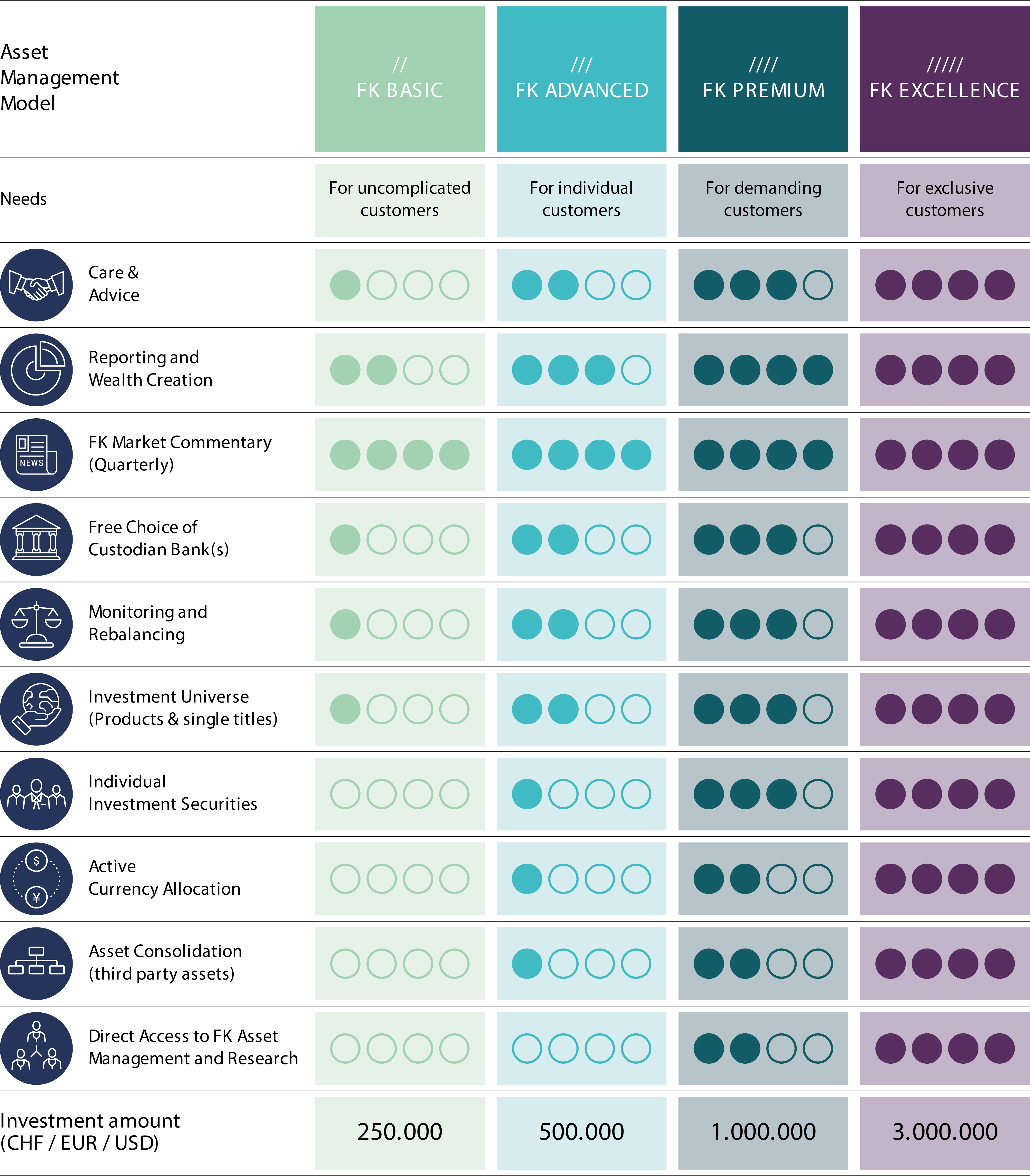

Choose your contract model

Depending on the scope of support and advice, desired monitoring, reporting and additional financial information, you can choose from four advisory services:

4.Implementation of your investment goals

Our portfolio management takes care of the implementation of your investment strategy. We always align your portfolio to the current market situation and economic situation. The dynamic interplay of the markets is paramount in our investment process.

THE INVESTMENT PROCESS

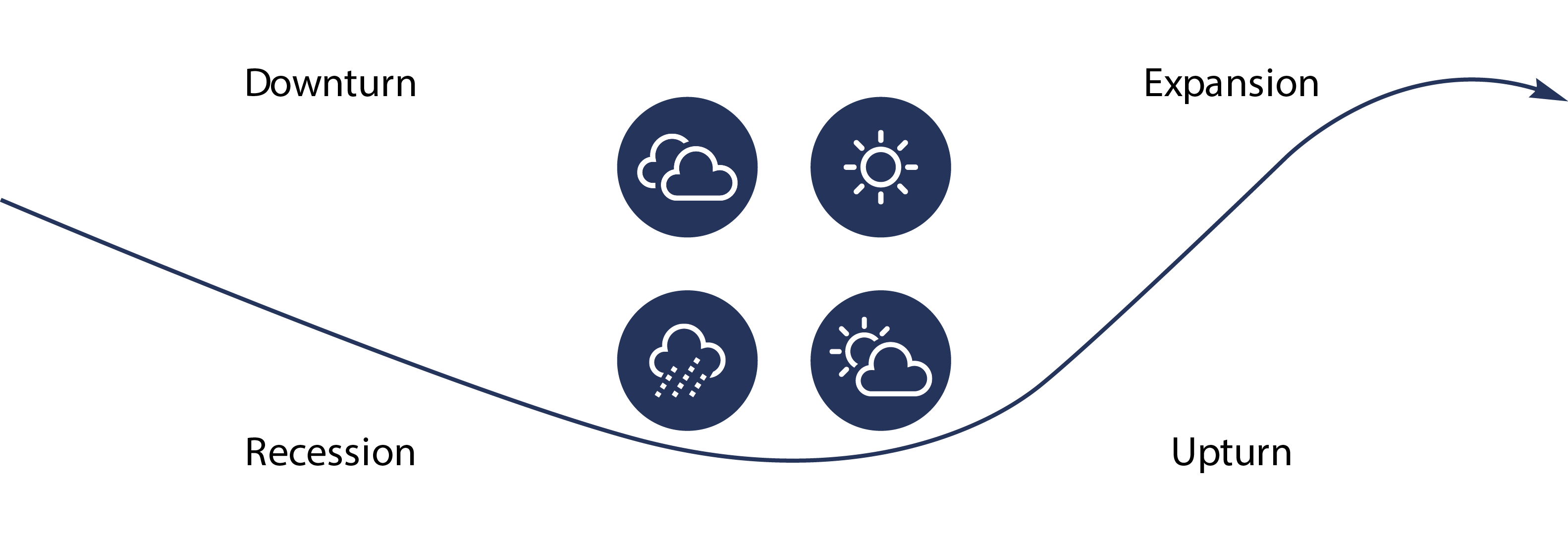

1. Business Cycle Analysis

(Qualitative Approach)

The basis for the investment process is the determination of the current stage in the economic cycle. Every month, over 50 weighted average fundamentals per economic area are analysed and indexed for their region of reference (USA, EU, CH). The results are compared with the last three months and equalised with a moving average, to eliminate short-term disruptions in the economic data and to avoid unnecessary rebalancing. The equalisation also allows for the most accurate forecast of the current economic stage (downturn, recession, upturn, expansion).

1.Identification of relevant economic indicators per economic area

2. Analysis, adjustment and summarisation of an index

3. Determination of the current phase in the economic cycle (monthly)

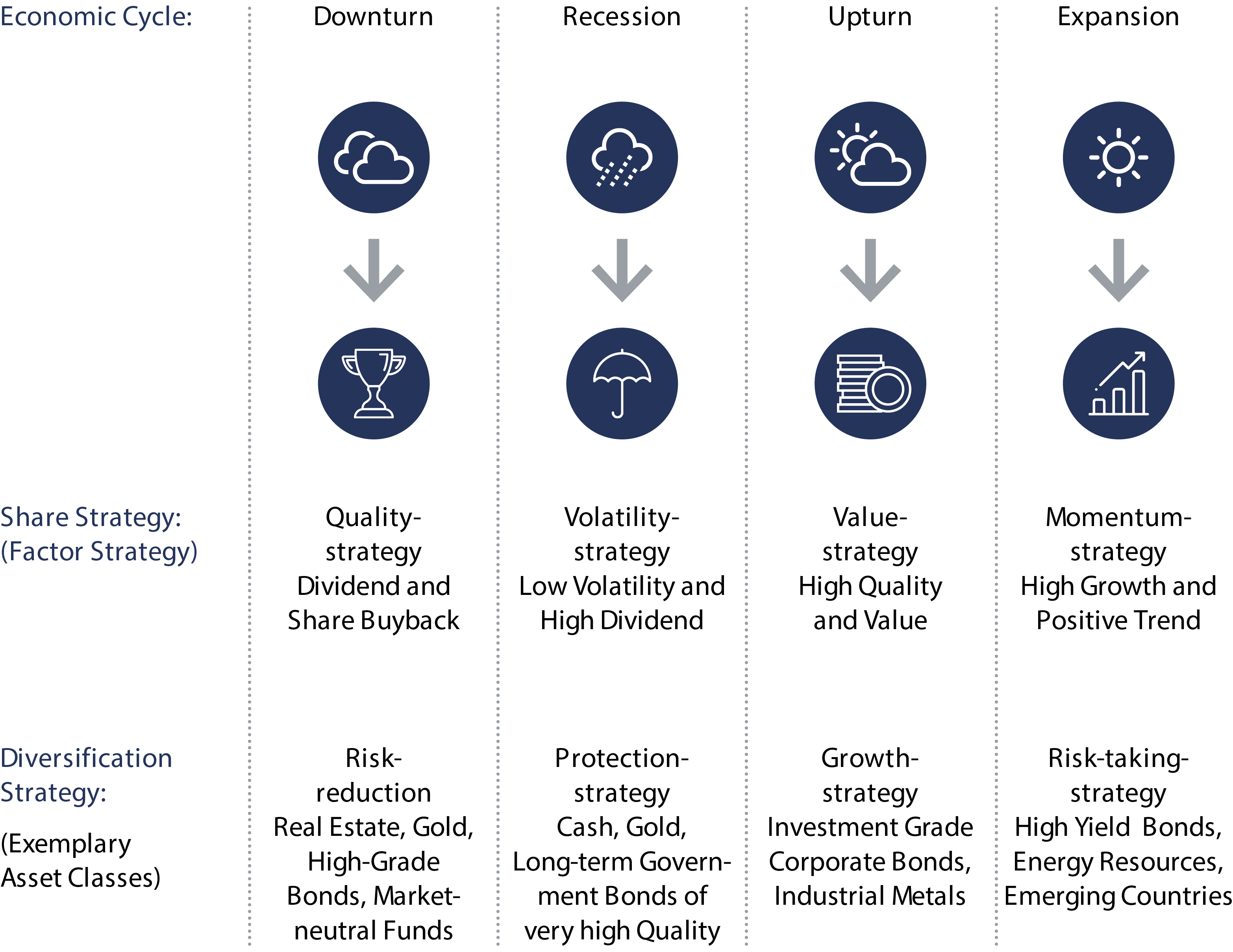

2. Monthly adjustment of the basic strategy according to the economic situation

On specific dates if the economic condition changes, the investment strategy is completely rotated to the pre-defined investment strategy appropriate for the relevant economic cycle. This means, due to the clearly defined parameters, an investment decision does not go through cumbersome investment committees and unnecessary process chains. Thus, we are always one step ahead in the implementation.

The underlying investment strategy is based on a scientifically recognised factor model as well as classical, continuously improved diversification strategies for the other asset classes. Depending on the market environment, we prefer different asset classes. Therefore, your investments are not simply statically left to their own devices.

5.Supervision and managing of assets

Our experts ensure your assets are permanently monitored and under strict risk control. We thoroughly and transparently inform you with a report on the development of your portfolio.

THE INVESTMENT PROCESS

3. Risk control –

Daily monitoring of the Equity Ratio (Quantitative Approach)

Superordinate to the flexible basic strategy, daily, dynamic, automated risk control is carried out, based on the short and medium-term volatility measures within the equity strategy. In the event of increasing risks, the equity ratio will promptly be reduced, in favour of bonds with excellent issuer quality. Depending on the economic cycle, the interest rate strategy is also adjusted. In an environment of rising interest rates, the focus is on short-term maturities and

in an environment of stagnating or falling interest rates on long-term maturities. This enables an additional return compared to similar strategies. The rebalancing takes place through clearly defined mathematical parameters and is free from individual decision makers. This ensures that the strategy is followed objectively and independent of people. With a strategy of such great flexibility, it is especially important to avoid emotional tendencies.

Effects of Volatility on the Equity Allocation

Implementation and reporting

Thanks to the collaboration with carefully selected Fintech partners, Finanz Konzept has the ability to rely on state-of-the-art IT solutions. Our platform covers the entire value chain within asset management. The perfection lies in the interplay of the individual modules with each other. This enables us to implement the investment strategies quickly and efficiently.

Thanks to an integrated risk and control system, we always have our individual goals in view. You can benefit from transparent investment reporting, which provides you with a detailed overview of your assets at all times. You can customize your report individually from more than 30 elements and, if desired, also integrate external assets into the report.

Our fonds:

- Triple Opportunity Fixed Income

Independent advice.

Agile decisions.

Flexible solutions.

“If you only walk on sunny days, you’ll never reach your destination.” – Chinese wisdom

Sign up for the market commentary.

We look forward to hearing from you and presenting our custom-made

consulting services. Get in touch with us.

In the newsroom you will find an overview of our market comments and publications.

Sign up for the market commentary.

We look forward to hearing from you and presenting our custom-made consulting services. Get in touch with us.