1.

Discussing

your

needs

Our experts ensure your assets are permanently monitored and under strict risk control. We thoroughly and transparently inform you with a report on the development of your portfolio.

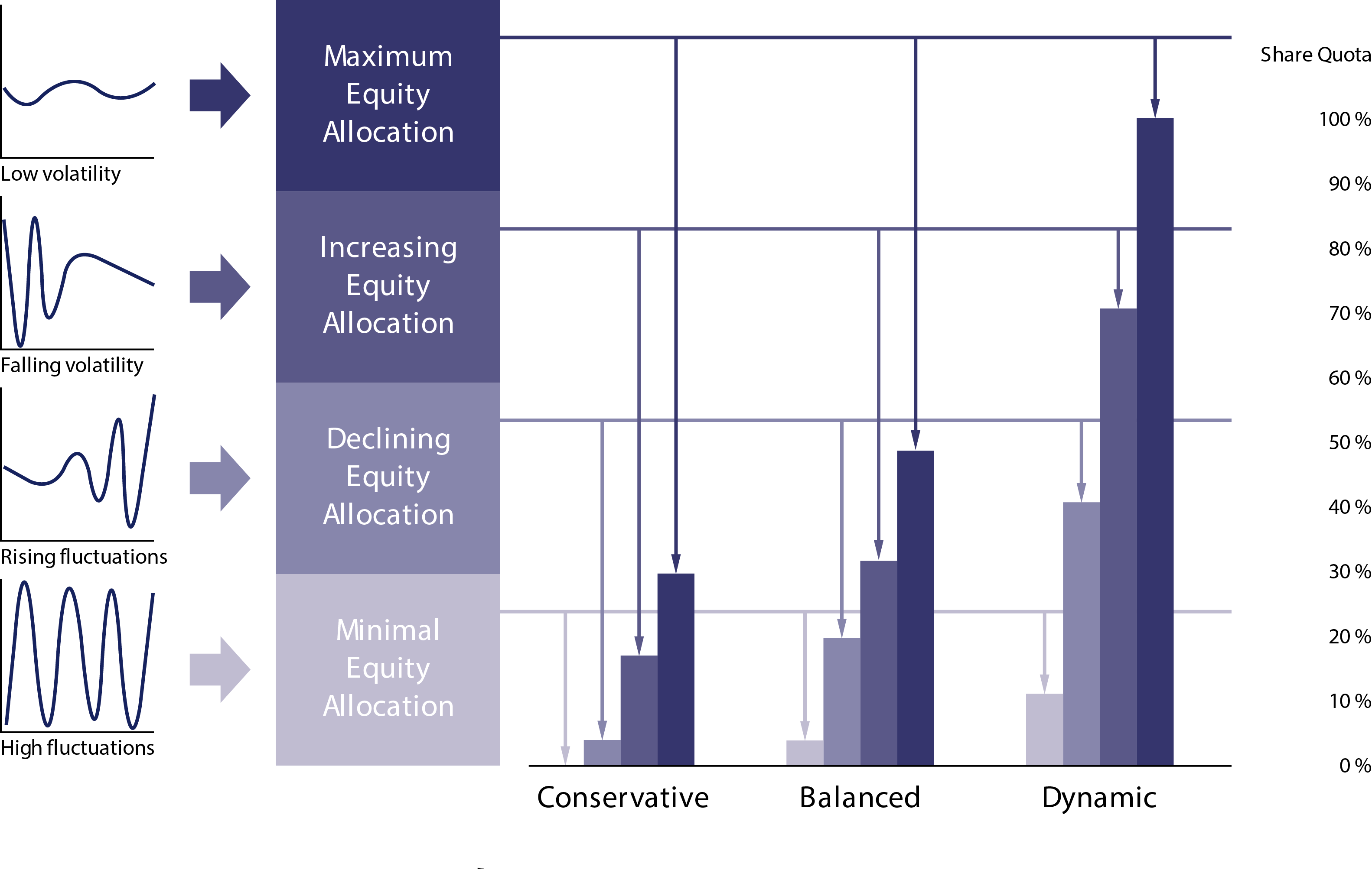

Superordinate to the flexible basic strategy, daily, dynamic, automated risk control is carried out, based on the short and medium-term volatility measures within the equity strategy. In the event of increasing risks, the equity ratio will promptly be reduced, in favour of bonds with excellent issuer quality. Depending on the economic cycle, the interest rate strategy is also adjusted. In an environment of rising interest rates, the focus is on short-term maturities and

in an environment of stagnating or falling interest rates on long-term maturities. This enables an additional return compared to similar strategies. The rebalancing takes place through clearly defined mathematical parameters and is free from individual decision makers. This ensures that the strategy is followed objectively and independent of people. With a strategy of such great flexibility, it is especially important to avoid emotional tendencies.

Thanks to the collaboration with carefully selected Fintech partners, Finanz Konzept has the ability to rely on state-of-the-art IT solutions. Our platform covers the entire value chain within asset management. The perfection lies in the interplay of the individual modules with each other. This enables us to implement the investment strategies quickly and efficiently.

Thanks to an integrated risk and control system, we always have our individual goals in view. You can benefit from transparent investment reporting, which provides you with a detailed overview of your assets at all times. You can customize your report individually from more than 30 elements and, if desired, also integrate external assets into the report.

“If you only walk on sunny days, you’ll never reach your destination.” – Chinese wisdom

We look forward to hearing from you and presenting our custom-made

consulting services. Get in touch with us.

In the newsroom you will find an overview of our market comments and publications.

We look forward to hearing from you and presenting our custom-made consulting services. Get in touch with us.